import os

import pickle

from tempfile import NamedTemporaryFile

import pandas as pd

import imfp

import webbrowser

# Function to display a DataFrame in a web browser

def view_dataframe_in_browser(df):

html = df.to_html()

with NamedTemporaryFile(delete=False, mode="w", suffix=".html") as f:

url = "file://" + f.name

f.write(html)

webbrowser.open(url)

# Function to load databases from CSV or fetch from API

def load_or_fetch_databases():

csv_path = os.path.join("data", "databases.csv")

# Try to load from CSV

if os.path.exists(csv_path):

try:

return pd.read_csv(csv_path)

except Exception as e:

print(f"Error loading CSV: {e}")

# If CSV doesn't exist or couldn't be loaded, fetch from API

print("Fetching databases from IMF API...")

databases = imfp.imf_databases()

# Save to CSV for future use

databases.to_csv(csv_path, index=False)

print(f"Databases saved to {csv_path}")

return databases

def load_or_fetch_parameters(database_name):

pickle_path = os.path.join("data", f"{database_name}.pickle")

# Try to load from pickle file

if os.path.exists(pickle_path):

try:

with open(pickle_path, "rb") as f:

return pickle.load(f)

except Exception as e:

print(f"Error loading pickle file: {e}")

# If pickle doesn't exist or couldn't be loaded, fetch from API

print(f"Fetching parameters for {database_name} from IMF API...")

parameters = imfp.imf_parameters(database_name)

# Save to pickle file for future use

os.makedirs("data", exist_ok=True) # Ensure the data directory exists

with open(pickle_path, "wb") as f:

pickle.dump(parameters, f)

print(f"Parameters saved to {pickle_path}")

return parameters

def load_or_fetch_dataset(database_id, indicator):

file_name = f"{database_id}.{indicator}.csv"

csv_path = os.path.join("data", file_name)

# Try to load from CSV file

if os.path.exists(csv_path):

try:

return pd.read_csv(csv_path)

except Exception as e:

print(f"Error loading CSV file: {e}")

# If CSV doesn't exist or couldn't be loaded, fetch from API

print(f"Fetching dataset for {database_id}.{indicator} from IMF API...")

dataset = imfp.imf_dataset(database_id=database_id, indicator=[indicator])

# Save to CSV file for future use

os.makedirs("data", exist_ok=True) # Ensure the data directory exists

dataset.to_csv(csv_path, index=False)

print(f"Dataset saved to {csv_path}")

return datasetEconomic Growth and Gender Equality: An Analysis Using IMF Data

This data analysis project aims to explore the relationship between economic growth and gender equality using imfp, which allows us to download data from IMF (International Monetary Fund). imfp can be integrated with other python tools to streamline the computational process. To demonstrate its functionality, the project experimented with a variety of visualization and analysis methods.

Executive Summary

In this project, we explored the following:

- Data Fetching

- Make API call to fetch 4 datasets: GII (Gender Inequality Index), Nominal GDP, GDP Deflator Index, Population series

- Feature Engineering

- Cleaning: Convert GDP Deflator Index to a yearly basis and variables to numeric

- Dependent Variable: Percent Change of Gender Inequality Index

- Independent Variable: Percent Change of Real GDP per Capita

- Transform variables to display magnitude of change

- Merge the datasets

- Data Visualization

- Scatterplot

- Time Series Line Plots

- Barplot

- Boxplot

- Heatmap

- Statistical Analysis

- Descriptive Statistics

- Regression Analysis

- Time Series Analysis

Utility Functions

The integration of other Python tools not only streamlined our computational processes but also ensured consistency across the project.

A custom module is written to simplify the process of making API calls and fetching information with imfp library. load_or_fetch_databases, load_or_fetch_parameters load_or_fetch_dataset load and retreive database, parameters, and dataset from a local or remote source. view_dataframe_in_browser displays dataframe in a web browser.

Dependencies

Here is a brief introduction about the packages used:

pandas: view and manipulate data frame

matplotlib.pyplot: make plots

seaborn: make plots

numpy: computation

LinearRegression: implement linear regression

tabulate: format data into tables

statsmodels.api, adfuller, ARIMA,VAR,plot_acf,plot_pacf,mean_absolute_error,mean_squared_error, andgrangercausalitytests are specifically used for time series analysis.

pycountry: convert between ISO2 and ISO3 country codes (install with pip install pycountry)

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

import numpy as np

from sklearn.linear_model import LinearRegression

from tabulate import tabulate

import statsmodels.api as sm

from statsmodels.tsa.stattools import adfuller

from statsmodels.tsa.arima.model import ARIMA

from statsmodels.tsa.vector_ar.var_model import VAR

from statsmodels.graphics.tsaplots import plot_acf, plot_pacf

from sklearn.metrics import mean_absolute_error

from sklearn.metrics import mean_squared_error

from statsmodels.tsa.stattools import grangercausalitytests

import pycountryData Fetching

In this section, we load four datasets: Gender Inequality Index (GII) from a CSV file, and fetch GDP Deflator, Nominal GDP, and Population through API calls to the IMF.

from pathlib import Path

Path("data").mkdir(exist_ok=True)# Load or fetch databases

databases = load_or_fetch_databases()

# Filter out databases that contain a year in the description

databases[

~databases['description'].str.contains(r"[\d]{4}", regex=True)

]

# view_dataframe_in_browser(databases)Fetching databases from IMF API...

Databases saved to data/databases.csv| database_id | description | |

|---|---|---|

| 0 | QGDP_WCA | Quarterly Gross Domestic Product (GDP), World ... |

| 1 | SPE | Special Purpose Entities (SPEs) |

| 2 | WPCPER | Crypto-based Parallel Exchange Rates (Working ... |

| 3 | MFS_IR | Monetary and Financial Statistics (MFS), Inter... |

| 4 | GFS_SSUC | GFS Statement of Sources and Uses of Cash |

| ... | ... | ... |

| 66 | FM | Fiscal Monitor (FM) |

| 67 | HPD | Historical Public Debt (HPD) |

| 68 | FSICDM | Financial Soundness Indicators (FSI), Concentr... |

| 69 | QGFS | Quarterly Government Finance Statistics (QGFS) |

| 70 | IRFCL | International Reserves and Foreign Currency Li... |

69 rows × 2 columns

Three IMF databases were used: World Economic Outlook (WEO), and National Economic Accounts (QNEA, ANEA).

The IMF has updated their API structure. The former IFS (International Financial Statistics) database has been discontinued and replaced with more specialized databases. This demo now uses:

- QNEA: Quarterly National Economic Accounts for GDP deflator

- ANEA: Annual National Economic Accounts for nominal GDP

- WEO: World Economic Outlook for population data

Note: The Gender Inequality Index (GII) is a UN dataset that is no longer available through the IMF API. We’ll load it from a pre-downloaded CSV file instead.

databases[databases['database_id'].isin(['QNEA','ANEA','WEO'])]| database_id | description | |

|---|---|---|

| 13 | QNEA | National Economic Accounts (NEA), Quarterly Data |

| 57 | WEO | World Economic Outlook (WEO) |

| 63 | ANEA | National Economic Accounts (NEA), Annual Data |

Parameters are dictionary key names to make requests from the databases. “country” is the ISO-3 code of the country. “indicator” refers to the code representing a specific dataset in the database.

datasets_list = ["QNEA", "ANEA", "WEO"]

params = {}

# Fetch valid parameters for datasets

for dataset in datasets_list:

params[dataset] = load_or_fetch_parameters(dataset)

valid_keys = list(params[dataset].keys())

print(f"Parameters for {dataset}: ", valid_keys)Fetching parameters for QNEA from IMF API...

Parameters saved to data/QNEA.pickle

Parameters for QNEA: ['country', 'indicator', 'price_type', 's_adjustment', 'type_of_transformation', 'frequency']

Fetching parameters for ANEA from IMF API...

Parameters saved to data/ANEA.pickle

Parameters for ANEA: ['country', 'indicator', 'price_type', 'type_of_transformation', 'frequency']

Fetching parameters for WEO from IMF API...

Parameters saved to data/WEO.pickle

Parameters for WEO: ['country', 'indicator', 'frequency']We’ll need to update the load_or_fetch_dataset function to handle the new database parameters:

def load_or_fetch_dataset_with_params(database_id, filename_suffix, **kwargs):

"""Fetch dataset with flexible parameters for new IMF databases"""

file_name = f"{database_id}.{filename_suffix}.csv"

csv_path = os.path.join("data", file_name)

# Try to load from CSV file

if os.path.exists(csv_path):

try:

return pd.read_csv(csv_path)

except Exception as e:

print(f"Error loading CSV file: {e}")

# If CSV doesn't exist or couldn't be loaded, fetch from API

print(f"Fetching dataset for {database_id}.{filename_suffix} from IMF API...")

dataset = imfp.imf_dataset(database_id=database_id, **kwargs)

# Save to CSV file for future use

os.makedirs("data", exist_ok=True)

dataset.to_csv(csv_path, index=False)

print(f"Dataset saved to {csv_path}")

return dataset

def convert_iso2_to_iso3(iso2_code):

"""Convert ISO2 country code to ISO3"""

try:

# Handle NaN or non-string values

if pd.isna(iso2_code) or not isinstance(iso2_code, str):

return None

country = pycountry.countries.get(alpha_2=iso2_code.upper())

return country.alpha_3 if country else None

except (KeyError, AttributeError, LookupError):

return NoneNow fetch the datasets using the new databases:

# Gender Inequality Index - Load from CSV (UN dataset, not available via IMF API)

GII_data = pd.read_csv("data/GENDER_EQUALITY.GE_GII.csv")

# Convert ISO2 country codes (ref_area) to ISO3 (country) to match IMF datasets

GII_data['country'] = GII_data['ref_area'].apply(convert_iso2_to_iso3)

# Drop rows where country code conversion failed

GII_data = GII_data.dropna(subset=['country'])

print(f"Loaded {len(GII_data)} GII observations")

print(f"Sample country codes: {GII_data['country'].unique()[:5]}")

# GDP Deflator (Quarterly, Index)

GDP_deflator_data = load_or_fetch_dataset_with_params(

"QNEA",

"B1GQ_PD_IX",

indicator="B1GQ",

price_type="PD", # Price deflator

type_of_transformation="IX", # Index

frequency="Q"

)

# Nominal GDP (Annual, Domestic Currency)

GDP_nominal_data = load_or_fetch_dataset_with_params(

"ANEA",

"B1GQ_V_XDC",

indicator="B1GQ",

price_type="V", # Current prices

type_of_transformation="XDC", # Domestic currency

frequency="A"

)

# Population (Annual)

GDP_population_data = load_or_fetch_dataset_with_params(

"WEO",

"LP",

indicator=["LP"],

frequency="A"

)Loaded 3065 GII observations

Sample country codes: ['AFG' 'ALB' 'DZA' 'ARG' 'ARM']

Fetching dataset for QNEA.B1GQ_PD_IX from IMF API.../tmp/ipykernel_7431/2514471997.py:5: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

GII_data['country'] = GII_data['ref_area'].apply(convert_iso2_to_iso3)Dataset saved to data/QNEA.B1GQ_PD_IX.csv

Fetching dataset for ANEA.B1GQ_V_XDC from IMF API...

Dataset saved to data/ANEA.B1GQ_V_XDC.csv

Fetching dataset for WEO.LP from IMF API...

Dataset saved to data/WEO.LP.csvFeature Engineering

Data Cleaning

Since the GDP deflator was reported on a quarterly basis, we converted it to a yearly basis.

# Keep only rows with a partial string match for "Q4" in the time_period column

GDP_deflator_data = GDP_deflator_data[GDP_deflator_data

['time_period'].str.contains("Q4")]# Split the time_period into year and quarter and keep the year only

GDP_deflator_data.loc[:, 'time_period'] = GDP_deflator_data['time_period'].str[0:4]We make all the variables numeric.

The new IMF API returns values in the correct units, so we no longer need to apply unit multipliers. The unit_mult column has been removed from most datasets.

datasets = [GII_data, GDP_deflator_data, GDP_nominal_data, GDP_population_data]

for i, dataset in enumerate(datasets):

# Use .loc to modify the columns

datasets[i].loc[:, 'obs_value'] = pd.to_numeric(datasets[i]['obs_value'],

errors='coerce')

datasets[i].loc[:, 'time_period'] = pd.to_numeric(datasets[i]['time_period'],

errors='coerce')GII Percent Change: Dependent Variable

We kept percents as decimals to make them easy to work with for calculation. Different countries have different baseline level of economic growth and gender equality. We calculated the percent change to make them comparable.

Gender Inequality Index (GII) is a composite measure of gender inequality using three dimensions: reproductive health, empowerment, and labor market. GII ranges from 0 to 1. While 0 indicates gender equality, 1 indicates gender inequality, possibly the worst outcome for one gender in all three dimensions.

# Calculate percent change for each country

# First, create a copy and reset the index to avoid duplicate index issues

GII_data_sorted = GII_data.sort_values(

['country', 'time_period']).reset_index(drop=True)

GII_data['pct_change'] = GII_data_sorted.groupby('country')['obs_value'].pct_change()

# Display the first few rows of the updated dataset

GII_data.head()| freq | ref_area | indicator | unit_mult | time_format | time_period | obs_value | country | pct_change | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | A | AF | GE_GII | 0 | P1Y | 1990 | 0.828244 | AFG | NaN |

| 1 | A | AF | GE_GII | 0 | P1Y | 1991 | 0.817706 | AFG | -0.012723 |

| 2 | A | AF | GE_GII | 0 | P1Y | 1992 | 0.809806 | AFG | -0.009662 |

| 3 | A | AF | GE_GII | 0 | P1Y | 1993 | 0.803078 | AFG | -0.008308 |

| 4 | A | AF | GE_GII | 0 | P1Y | 1994 | 0.797028 | AFG | -0.007533 |

We subset the data frame to keep only the columns we want:

# Create a new dataframe with only the required columns

GII_data = GII_data[['country', 'time_period', 'obs_value', 'pct_change']].copy()

GII_data = GII_data.rename(columns = {

'country': 'Country',

'time_period': 'Time',

'obs_value': 'GII',

'pct_change': 'GII_change'

})

# Display the first few rows of the new dataset

GII_data.head()| Country | Time | GII | GII_change | |

|---|---|---|---|---|

| 0 | AFG | 1990 | 0.828244 | NaN |

| 1 | AFG | 1991 | 0.817706 | -0.012723 |

| 2 | AFG | 1992 | 0.809806 | -0.009662 |

| 3 | AFG | 1993 | 0.803078 | -0.008308 |

| 4 | AFG | 1994 | 0.797028 | -0.007533 |

GDP Percent Change: Independent Variable

Real GDP per capita is a measure of a country’s economic welfare or standard of living. It is a great tool comparing a country’s economic development compared to other economies. Due to dataset access issue, we calculated Real GDP per capita by the following formula using GDP Deflator, Nominal GDP, and Population data:

\(\text{Real GDP} = \frac{\text{Nominal GDP}}{\text{GDP Deflator Index}}\times 100\)

\(\text{Real GDP per capita} = \frac{\text{Real GDP}}{\text{Population}}\)

GDP Deflator is a measure of price inflation and deflation with respect to a specific base year. The GDP deflator of a base year is equal to 100. A number of 200 indicates price inflation: the current year price of the good is twice its base year price. A number of 50 indicates price deflation: the current year price of the good is half its base year price. We kept the columns we want only for GDP-related datasets for easier table merging.

# GDP Deflator Dataset

# Create a new dataframe with only the required columns

GDP_deflator_data = GDP_deflator_data[

['country', 'time_period', 'obs_value']].copy()

# Display the first few rows of the new dataset

GDP_deflator_data.head()| country | time_period | obs_value | |

|---|---|---|---|

| 3 | ALB | 1996 | 55.229150 |

| 7 | ALB | 1997 | 60.439943 |

| 11 | ALB | 1998 | 63.745473 |

| 15 | ALB | 1999 | 67.101488 |

| 19 | ALB | 2000 | 70.301830 |

Nominal GDP is the total value of all goods and services produced in a given time period. It is usually higher than Real GDP and does not take into account cost of living in different countries or price change due to inflation/deflation.

# GDP Nominal Data

# Create a new dataframe with only the required columns

GDP_nominal_data = GDP_nominal_data[

['country', 'time_period', 'obs_value']].copy()

# Display the first few rows of the new dataset

GDP_nominal_data.head()| country | time_period | obs_value | |

|---|---|---|---|

| 0 | AFG | 2010 | 7.035025e+11 |

| 1 | AFG | 2011 | 8.378513e+11 |

| 2 | AFG | 2012 | 1.007959e+12 |

| 3 | AFG | 2013 | 1.102256e+12 |

| 4 | AFG | 2014 | 1.116353e+12 |

Population is the total number of people living in a country at a given time. This is where the “per capita” comes from. Real GDP is the total value of all goods and services produced in a country adjusted for inflation. Real GDP per capita is the total economic output per person in a country.

# GDP Population Data

# Create a new dataframe with only the required columns

GDP_population_data = GDP_population_data[

['country', 'time_period', 'obs_value']].copy()

# Display the first few rows of the new dataset

GDP_population_data.head()| country | time_period | obs_value | |

|---|---|---|---|

| 0 | ABW | 1986 | 81000.0 |

| 1 | ABW | 1987 | 85000.0 |

| 2 | ABW | 1988 | 88000.0 |

| 3 | ABW | 1989 | 89000.0 |

| 4 | ABW | 1990 | 90000.0 |

# Combine all the datasets above for further calculation

merged_df = pd.merge(pd.merge(GDP_deflator_data, GDP_nominal_data,

on=['time_period', 'country'],

suffixes=('_index', '_nominal'),

how='inner'),

GDP_population_data,

on=['time_period', 'country'],

how='inner')

# Rename columns for clarity

merged_df = merged_df.rename(columns={

'obs_value_index': 'deflator',

'obs_value_nominal': 'nominal',

'obs_value': 'population'

})

# Display the first few rows of the dataset

merged_df.head()| country | time_period | deflator | nominal | population | |

|---|---|---|---|---|---|

| 0 | ALB | 1996 | 55.229150 | 3.380003e+11 | 3168000.0 |

| 1 | ALB | 1997 | 60.439943 | 3.364808e+11 | 3148000.0 |

| 2 | ALB | 1998 | 63.745473 | 3.930700e+11 | 3129000.0 |

| 3 | ALB | 1999 | 67.101488 | 4.535123e+11 | 3109000.0 |

| 4 | ALB | 2000 | 70.301830 | 5.162068e+11 | 3089000.0 |

We wanted to compute the Real GDP per capita.

# Step 1: Real GDP = (Nominal GDP / GDP Deflator Index)*100

merged_df['Real_GDP_domestic'] = (merged_df['nominal'] / merged_df[

'deflator'])*100

# Step 2: Real GDP per Capita = Real GDP / Population

merged_df['Real_GDP_per_capita'] = merged_df['Real_GDP_domestic'] / merged_df[

'population']

# Rename columns

merged_df = merged_df.rename(columns= {

"country": "Country",

"time_period": "Time",

"nominal": "Nominal",

"deflator": "Deflator",

"population": "Population",

"Real_GDP_domestic": "Real GDP",

"Real_GDP_per_capita": "Real GDP per Capita"

}

)

# Check the results

merged_df.head()/tmp/ipykernel_7431/1437906122.py:2: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

merged_df['Real_GDP_domestic'] = (merged_df['nominal'] / merged_df[

/tmp/ipykernel_7431/1437906122.py:6: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

merged_df['Real_GDP_per_capita'] = merged_df['Real_GDP_domestic'] / merged_df[| Country | Time | Deflator | Nominal | Population | Real GDP | Real GDP per Capita | |

|---|---|---|---|---|---|---|---|

| 0 | ALB | 1996 | 55.229150 | 3.380003e+11 | 3168000.0 | 6.119962e+11 | 193180.623583 |

| 1 | ALB | 1997 | 60.439943 | 3.364808e+11 | 3148000.0 | 5.567193e+11 | 176848.560331 |

| 2 | ALB | 1998 | 63.745473 | 3.930700e+11 | 3129000.0 | 6.166241e+11 | 197067.474349 |

| 3 | ALB | 1999 | 67.101488 | 4.535123e+11 | 3109000.0 | 6.758603e+11 | 217388.325042 |

| 4 | ALB | 2000 | 70.301830 | 5.162068e+11 | 3089000.0 | 7.342722e+11 | 237705.465473 |

We calculated the percentage change in Real GDP per capita and put it in a new column.

# Calculate percent change for each country

merged_df[f'GDP_change'] = merged_df.sort_values(['Country', 'Time']).groupby(

'Country')['Real GDP per Capita'].pct_change()

# Rename dataset

GDP_data = merged_df

# Display the first few rows of the dataset

GDP_data.head()/tmp/ipykernel_7431/776684234.py:2: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

merged_df[f'GDP_change'] = merged_df.sort_values(['Country', 'Time']).groupby(| Country | Time | Deflator | Nominal | Population | Real GDP | Real GDP per Capita | GDP_change | |

|---|---|---|---|---|---|---|---|---|

| 0 | ALB | 1996 | 55.229150 | 3.380003e+11 | 3168000.0 | 6.119962e+11 | 193180.623583 | NaN |

| 1 | ALB | 1997 | 60.439943 | 3.364808e+11 | 3148000.0 | 5.567193e+11 | 176848.560331 | -0.084543 |

| 2 | ALB | 1998 | 63.745473 | 3.930700e+11 | 3129000.0 | 6.166241e+11 | 197067.474349 | 0.114329 |

| 3 | ALB | 1999 | 67.101488 | 4.535123e+11 | 3109000.0 | 6.758603e+11 | 217388.325042 | 0.103116 |

| 4 | ALB | 2000 | 70.301830 | 5.162068e+11 | 3089000.0 | 7.342722e+11 | 237705.465473 | 0.093460 |

# GII and GDP

# Merge the datasets

combined_data = pd.merge(GII_data, GDP_data,

on=["Country", "Time"],

how = "inner")

# Check the combined dataset

combined_data.head()/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/pandas/core/reshape/merge.py:1548: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

self.left[name] = self.left[name].astype(typ)| Country | Time | GII | GII_change | Deflator | Nominal | Population | Real GDP | Real GDP per Capita | GDP_change | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | ALB | 1996 | 0.340120 | 0.031715 | 55.229150 | 3.380003e+11 | 3168000.0 | 6.119962e+11 | 193180.623583 | NaN |

| 1 | ALB | 1997 | 0.352818 | 0.037334 | 60.439943 | 3.364808e+11 | 3148000.0 | 5.567193e+11 | 176848.560331 | -0.084543 |

| 2 | ALB | 1998 | 0.368950 | 0.045723 | 63.745473 | 3.930700e+11 | 3129000.0 | 6.166241e+11 | 197067.474349 | 0.114329 |

| 3 | ALB | 1999 | 0.393371 | 0.066190 | 67.101488 | 4.535123e+11 | 3109000.0 | 6.758603e+11 | 217388.325042 | 0.103116 |

| 4 | ALB | 2000 | 0.390317 | -0.007762 | 70.301830 | 5.162068e+11 | 3089000.0 | 7.342722e+11 | 237705.465473 | 0.093460 |

Data Visualization

Scatterplot

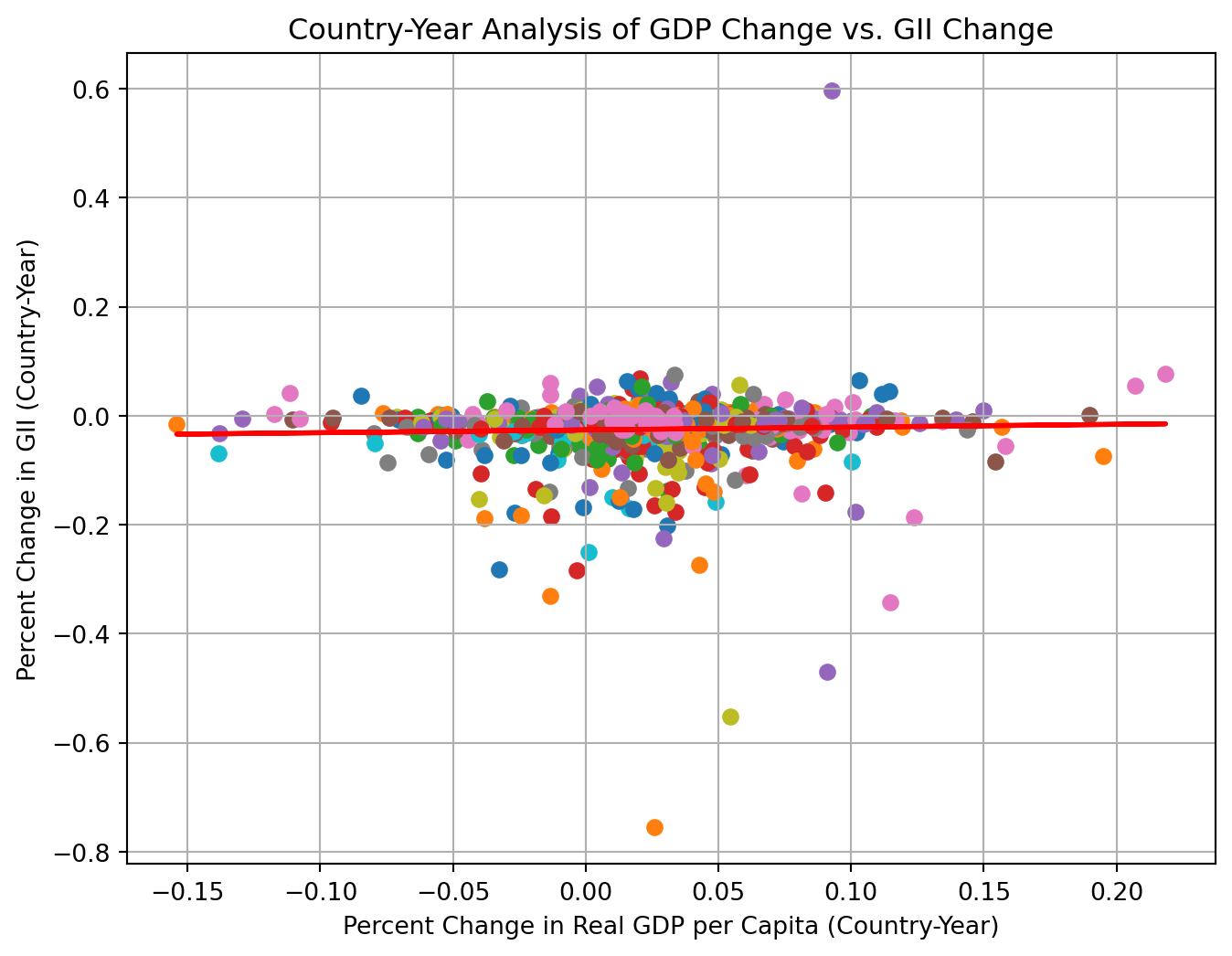

Scatterplot use dots to represent values of two numeric variables. The horizontal axis was the percent change in Real GDP per capita. The vertical axis was the percent change in Gender Inequality Index(GII). Different colors represented different countries. We used a linear regression line to display the overall pattern.

Based on the scatterplot, it seemed like there was a slight positive relationship between GDP change and GII change as shown by the flat regression line. Gender inequality was decreasing (gender equality was improving) a little faster in country-years with low GDP growth and a little slower in country-years with high GDP growth.

# Convert numeric columns to float

numeric_columns = [

'GII', 'GII_change', 'Nominal', 'Deflator', 'Population',

'Real GDP', 'Real GDP per Capita', 'GDP_change'

]

for col in numeric_columns:

combined_data[col] = pd.to_numeric(combined_data[col], errors='coerce')

# Count NAs

print(f"Dropping {combined_data[numeric_columns].isna().sum()} rows with NAs")

# Drop NAs

combined_data = combined_data.dropna(subset=numeric_columns)

# Plot the data points

plt.figure(figsize=(8, 6))

for country in combined_data['Country'].unique():

country_data = combined_data[combined_data['Country'] == country]

plt.scatter(country_data['GDP_change'], country_data['GII_change'],

marker='o',linestyle='-', label=country)

plt.title('Country-Year Analysis of GDP Change vs. GII Change')

plt.xlabel('Percent Change in Real GDP per Capita (Country-Year)')

plt.ylabel('Percent Change in GII (Country-Year)')

plt.grid(True)

# Prepare data for linear regression

X = combined_data['GDP_change'].values.reshape(-1, 1)

y = combined_data['GII_change'].values

# Perform linear regression

reg = LinearRegression().fit(X, y)

y_pred = reg.predict(X)

# Plot the regression line

plt.plot(combined_data['GDP_change'], y_pred, color='red', linewidth=2)

plt.show()Dropping GII 0

GII_change 42

Nominal 0

Deflator 0

Population 0

Real GDP 0

Real GDP per Capita 0

GDP_change 39

dtype: int64 rows with NAs/tmp/ipykernel_7431/207802317.py:7: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

combined_data[col] = pd.to_numeric(combined_data[col], errors='coerce')

Time Series Line Plot

We created separate line plots for GDP change and GII change over time for a few key countries might show the trends more clearly.

US: United States

JP: Japan

GB: United Kindom

FR: France

MX: Mexico

Based on the line plots, we saw GDP change and GII change have different patterns. For example, in Mexico, when there was a big change in real GDP per captia in 1995, the change in GII was pretty stable.

# Time Series Line plot for a few key countries

selected_countries = ['US', 'JP', 'GB', 'FR', 'MX']

combined_data_selected = combined_data[combined_data['Country'].isin(selected_countries)]

# Set up the Plot Structure

fig, ax = plt.subplots(2, 1, figsize=(8, 6), sharex=True)

# Plot change in real GDP per capita over time

sns.lineplot(data = combined_data_selected,

x = "Time",

y = "GDP_change",

hue = "Country",

ax = ax[0])

ax[0].set_title("Percent Change in Real GDP per Capita Over Time")

ax[0].set_ylabel("Percent Change in Real GDP per Capita")

# Plot change in GII over time

sns.lineplot(data = combined_data_selected,

x = "Time",

y = "GII_change",

hue = "Country",

ax = ax[1])

ax[1].set_title("Percent Change in GII over Time")

ax[1].set_xlabel("Time")

ax[1].set_ylabel("GII")

plt.tight_layout

plt.show()

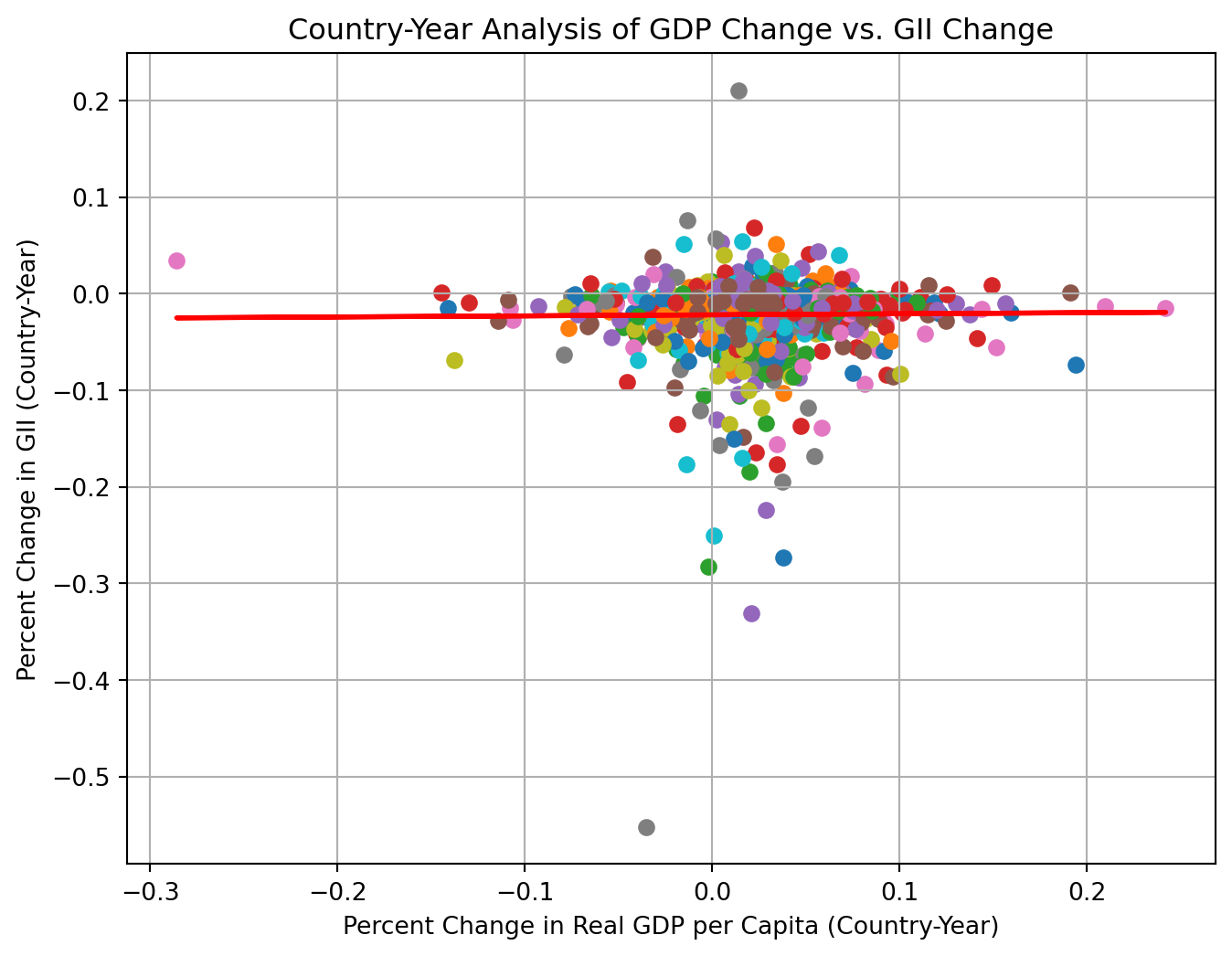

Barplot

We used a barplot to show average changes in GII and GDP percent change for each country to visualize regions where inequality was improving or worsening.

This plot supported our previous observation how GII change seemed to be not be correlated with GDP change. We also saw that, for country SI, Solvenia, there seems to be a large improvement in gender inequality.

# Barplot using average GII and GDP change

# Calculate average change for each country

combined_data_avg = combined_data.groupby('Country')[

['GII_change','GDP_change']].mean().reset_index()

# Prepare to plot structure

plt.figure(figsize = (18,10))

# Create the barplot

combined_data_avg.plot(kind = 'bar', x = 'Country')

plt.ylabel('Average Change')

plt.xlabel('Country')

plt.legend(['GII change', 'GDP change'])

plt.grid(axis = 'y')

# Show the plot

plt.show()<Figure size 1728x960 with 0 Axes>

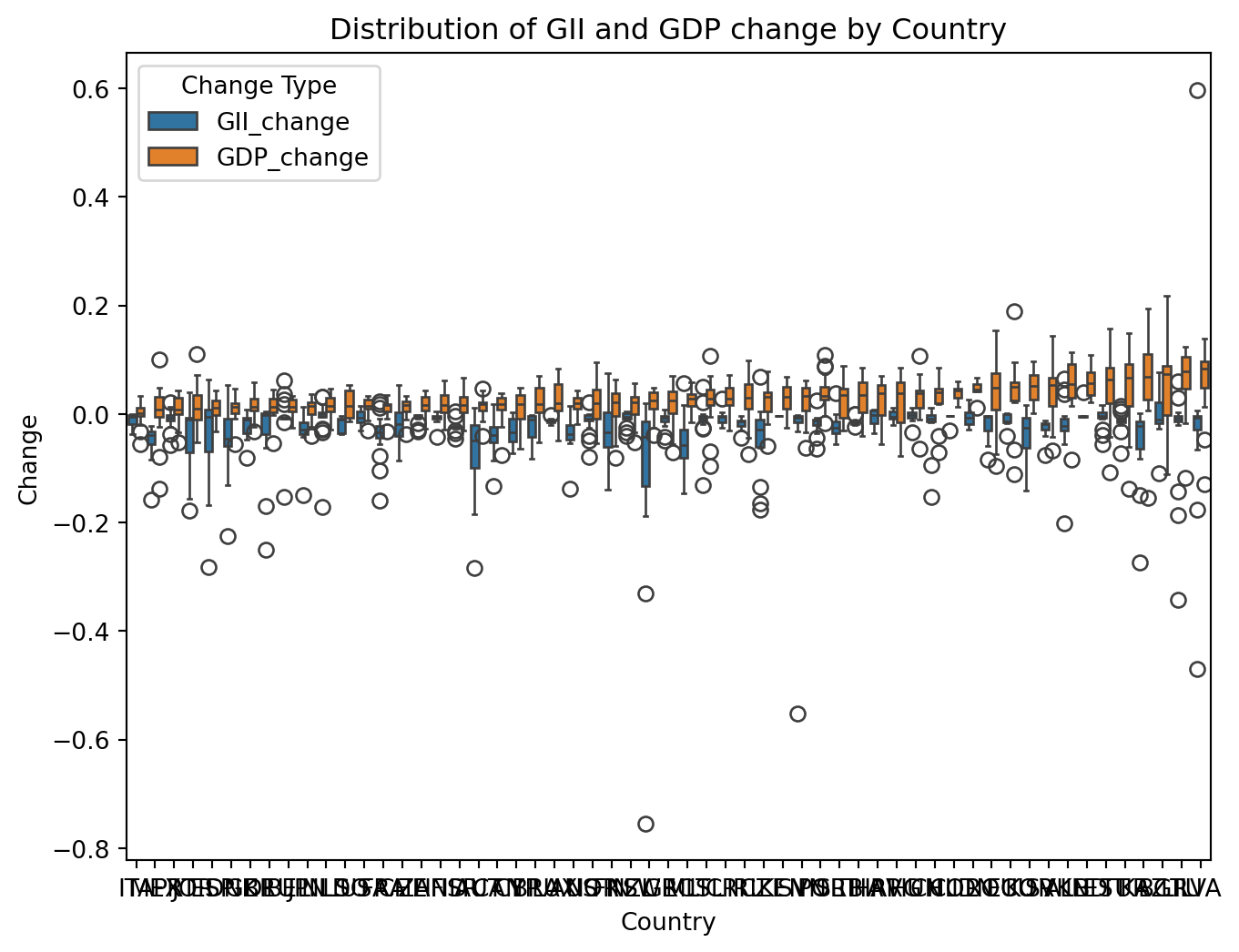

Boxplot

We used boxplot to visualize the distribution of GDP and GII change by country, providing information about spread, median, and potential outliers. To provide a more informative view, we sequenced countries in an ascending order by the median of percent change in GDP.

The boxplot displayed a slight upward trend with no obvious pattern between GDP and GII change. In coutries with higher GDP change median, they also tend to have a larger spread of the GDP change. The median of GII change remained stable regardless of the magnitude of GDP change, implying weak or no association between GDP and GII change. We observed a potential outlier for country SI, Solvenia, which may explained its large improvement in Gender inequality.

# Box plot for GII and GDP change

# Melt the dataframe to long format for combined boxplot

combined_data_melted = combined_data.melt(id_vars=['Country'],

value_vars=['GII_change', 'GDP_change'],

var_name='Change_Type',

value_name='Value')

gdp_medians = combined_data.groupby('Country')['GDP_change'].median().sort_values()

combined_data_melted['Country'] = pd.Categorical(combined_data_melted['Country'],

categories=gdp_medians.index,

ordered= True)

# Prepare the plot structure

plt.figure(figsize=(8, 6))

sns.boxplot(data = combined_data_melted,

x = "Country",

y = 'Value',

hue = 'Change_Type')

plt.title('Distribution of GII and GDP change by Country')

plt.xlabel('Country')

plt.ylabel('Change')

plt.legend(title = 'Change Type')

# Show the plot

plt.show()/tmp/ipykernel_7431/629035303.py:10: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

combined_data_melted['Country'] = pd.Categorical(combined_data_melted['Country'],

/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/seaborn/_base.py:1447: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

self.plot_data[axis] = cat_data

/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/seaborn/categorical.py:403: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

data["width"] /= n

/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/seaborn/categorical.py:407: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

data[self.orient] += offset

/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/seaborn/categorical.py:415: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

data["edge"] = inv(data[var] - hw)

/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/seaborn/categorical.py:416: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

data["width"] = inv(data[var] + hw) - data["edge"].to_numpy()

/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/seaborn/categorical.py:419: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

data[col] = inv(data[col])

/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/seaborn/categorical.py:654: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

stats[stat] = inv(stats[stat])

/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/seaborn/categorical.py:655: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

stats["fliers"] = stats["fliers"].map(inv)

/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/seaborn/categorical.py:403: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

data["width"] /= n

/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/seaborn/categorical.py:407: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

data[self.orient] += offset

/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/seaborn/categorical.py:415: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

data["edge"] = inv(data[var] - hw)

/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/seaborn/categorical.py:416: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

data["width"] = inv(data[var] + hw) - data["edge"].to_numpy()

/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/seaborn/categorical.py:419: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

data[col] = inv(data[col])

/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/seaborn/categorical.py:654: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

stats[stat] = inv(stats[stat])

/home/runner/work/imfp/imfp/.venv/lib/python3.14/site-packages/seaborn/categorical.py:655: FutureWarning: ChainedAssignmentError: behaviour will change in pandas 3.0!

You are setting values through chained assignment. Currently this works in certain cases, but when using Copy-on-Write (which will become the default behaviour in pandas 3.0) this will never work to update the original DataFrame or Series, because the intermediate object on which we are setting values will behave as a copy.

A typical example is when you are setting values in a column of a DataFrame, like:

df["col"][row_indexer] = value

Use `df.loc[row_indexer, "col"] = values` instead, to perform the assignment in a single step and ensure this keeps updating the original `df`.

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

stats["fliers"] = stats["fliers"].map(inv)

Correlation Matrix

We created a heatmap to show the relationship between GII and GDP change.

A positive correlation coefficient indicates a positive relationship: the larger the GDP change, the larger the GII change. A negative correlation coefficient indicates a negative relationship: the larger the GDP change, the smaller the GII change. A correlation coefficient closer to 0 indicates there is weak or no relationship.

Based on the numeric values in the plot, there was a moderately strong positive correlation between GII and GDP change for country Estonia(EE) and Ireland(IE).

# Calculate the correlation

country_correlation = combined_data.groupby('Country')[

['GII_change', 'GDP_change']].corr().iloc[0::2, -1].reset_index(name='Correlation')

# Put the correlation value in a matrix format

correlation_matrix = country_correlation.pivot(index='Country',

columns='level_1',

values='Correlation')

# Check for NaN values in the correlation matrix

# Replace NaNs with 0 or another value as appropriate

correlation_matrix.fillna(0, inplace=True)

# Set up the plot structure

# Adjust height to give more space for y-axis labels

plt.figure(figsize=(8, 12))

# Plot the heatmap

sns.heatmap(correlation_matrix, annot=True, cmap='coolwarm', center=0,

cbar_kws={"shrink": .8},

linewidths=.5)

# Enhance axis labels and title

plt.title('Heatmap for GII and GDP Change', fontsize=20)

plt.xlabel('Variables', fontsize=16)

plt.ylabel('Country', fontsize=16)

# Improve readability of y-axis labels

plt.yticks(fontsize=12) # Adjust the font size for y-axis labels

# Show the plot

plt.show()

Statistical Analysis

Descriptive Statistics

There was a total of 915 data points. The mean of the GII change in -0.0314868, which indicated the overall grand mean percent change in gender inequality index is -3.15%. The mean of the GDP change was 0.0234633, showing the overall grand mean percent change in real GDP per capita was 2.35%.

# Generate summary statistics

combined_data.describe()| GII | GII_change | Deflator | Nominal | Population | Real GDP | Real GDP per Capita | GDP_change | |

|---|---|---|---|---|---|---|---|---|

| count | 926.000000 | 926.000000 | 926.000000 | 9.260000e+02 | 9.260000e+02 | 9.260000e+02 | 9.260000e+02 | 926.000000 |

| mean | 0.238421 | -0.024551 | 85.105692 | 8.110427e+13 | 4.417935e+07 | 8.091261e+13 | 1.228489e+06 | 0.025226 |

| std | 0.147533 | 0.057831 | 20.989600 | 5.980526e+14 | 1.244702e+08 | 5.514331e+14 | 4.116173e+06 | 0.041567 |

| min | 0.011528 | -0.755003 | 3.606478 | 4.005511e+09 | 2.680000e+05 | 5.214273e+09 | 1.874604e+03 | -0.154124 |

| 25% | 0.130789 | -0.032348 | 73.539433 | 1.213369e+11 | 4.557500e+06 | 1.634228e+11 | 1.961630e+04 | 0.005294 |

| 50% | 0.187900 | -0.012143 | 88.452521 | 8.119985e+11 | 1.027900e+07 | 1.063447e+12 | 3.652494e+04 | 0.023782 |

| 75% | 0.331948 | -0.003514 | 100.098241 | 2.591000e+12 | 4.416775e+07 | 2.941241e+12 | 2.729200e+05 | 0.044982 |

| max | 0.788954 | 0.597437 | 207.819554 | 9.546134e+15 | 1.295830e+09 | 7.918681e+15 | 3.182519e+07 | 0.218521 |

Regression Analysis

Simple linear regression as a foundational approach provide us with a basic understanding of the relationship between GDP change and GII change.

Based on the summary, we concluded the following:

Becasue p-value = 0.057, if we set alpha, the significance level, to be 0.05, we failed to reject the null hypothesis and conclude there was no significant relationship between percent change in real GDP per capita and gender inequality index.

R-squared = 0.004. Only 0.4% of the variance in GII change could be explained by GDP change.

We were 95% confident that the interval from -0.003 to 0.169 captured the true slope of GDP change. Because 0 was included, we are uncertain about the effect of GDP change on GII chnage.

# Get column data type summaries of combined_data

combined_data.info()<class 'pandas.core.frame.DataFrame'>

Index: 926 entries, 1 to 1005

Data columns (total 10 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Country 926 non-null object

1 Time 926 non-null object

2 GII 926 non-null float64

3 GII_change 926 non-null float64

4 Deflator 926 non-null float64

5 Nominal 926 non-null float64

6 Population 926 non-null float64

7 Real GDP 926 non-null float64

8 Real GDP per Capita 926 non-null float64

9 GDP_change 926 non-null float64

dtypes: float64(8), object(2)

memory usage: 79.6+ KB# Define independent and depenent variables

X = combined_data['GDP_change']

y = combined_data['GII_change']

# Add a constant to indepdent variable to include an intercept

X = sm.add_constant(X)

# Fit a simple linear regresion model and print out the summary

model = sm.OLS(y, X).fit()

model.summary()| Dep. Variable: | GII_change | R-squared: | 0.001 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 0.000 |

| Method: | Least Squares | F-statistic: | 1.256 |

| Date: | Mon, 10 Nov 2025 | Prob (F-statistic): | 0.263 |

| Time: | 22:49:34 | Log-Likelihood: | 1326.5 |

| No. Observations: | 926 | AIC: | -2649. |

| Df Residuals: | 924 | BIC: | -2639. |

| Df Model: | 1 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | -0.0258 | 0.002 | -11.625 | 0.000 | -0.030 | -0.021 |

| GDP_change | 0.0513 | 0.046 | 1.121 | 0.263 | -0.039 | 0.141 |

| Omnibus: | 812.205 | Durbin-Watson: | 1.517 |

|---|---|---|---|

| Prob(Omnibus): | 0.000 | Jarque-Bera (JB): | 118816.101 |

| Skew: | -3.324 | Prob(JB): | 0.00 |

| Kurtosis: | 58.093 | Cond. No. | 24.1 |

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

Time Series Analysis

Time series analysis allows us to explore how the relationship between GII and GDP change vary across different time periods, accounting for lagged effects.

Here was a quick summary of the result:

Both GII and GDP change time series were stationary.

Past GII change values significantly influenced cuurent GII change values.

VAR model had good model performance on forecasting future values based on historical data.

Changes in GDP did not cause/precde the changes in GII.

ADF Test: Stationality Assumption Check

We wanted to use Augmented Dickey-Fuller (ADF) test to check whether a time series was stationary, which was the model assumption for many time series models.

Stationarity implied constant mean and variance over time, making it more predictable and stable for forecasting.

Based on the ADF test output, both GII and GDP change time series were stationary. We proceeded to the time series modeling section.

# Augmented Dickey-Fuller (ADF) test for stationarity check

# Create melted datasets

combined_data_time = combined_data.melt(id_vars=['Time', 'Country'],

value_vars=['GII_change','GDP_change'],

var_name = 'Change_Type',

value_name = 'Value')

GII = combined_data_time[(combined_data_time['Change_Type'] == 'GII_change')]

GDP = combined_data_time[(combined_data_time['Change_Type'] == 'GDP_change')]

# Stationary Check

def adf_test(series):

result = adfuller(series.dropna())

print(f'ADF Statistic: {result[0]}')

print(f'p-value: {result[1]}')

if result[1] < 0.05:

print("Series is stationary")

else:

print("Series is not stationary")

# Output the result

adf_test(GII['Value'])

adf_test(GDP['Value'])ADF Statistic: -14.373733898266707

p-value: 9.400076395122232e-27

Series is stationary

ADF Statistic: -11.630733942799152

p-value: 2.265900981797003e-21

Series is stationaryVAR model: Examine variables separately

We fitted a VAR (Vector Autoreression) model to see the relationship between GII and GDP change. VAR is particularly useful when dealing with multivariate time series data and allows us to examine the interdependence between variables.

Based on summary, here were several interpretations we could make:

We used AIC as the criteria for model selection. Lower value suggests a better fit.

Given that we wanted to predict GII change, we focused on the first set “Results for equation GII_change.”

Past GII_change values significantly influenced current GII_change, as shown in the small p-values of lags 1 and 2.

Lag 2 of GDP_change had a relatively low p-value but is not statistically significant.

# Split the dataset into training and testing sets

split_ratio = 0.7

split_index = int(len(combined_data) * split_ratio)

# Training set is used to fit the model

train_data = combined_data.iloc[:split_index]

# Testing set is used for validation

test_data = combined_data.iloc[split_index:]

print(f"Training data: {train_data.shape}")

print(f"Test data: {test_data.shape}")Training data: (648, 10)

Test data: (278, 10)# Fit a VAR model

time_model = VAR(train_data[['GII_change', 'GDP_change']])

time_model_fitted = time_model.fit(maxlags = 15, ic="aic")

# Print out the model summary

time_model_fitted.summary() Summary of Regression Results

==================================

Model: VAR

Method: OLS

Date: Mon, 10, Nov, 2025

Time: 22:49:34

--------------------------------------------------------------------

No. of Equations: 2.00000 BIC: -12.0280

Nobs: 641.000 HQIC: -12.1558

Log likelihood: 2132.84 FPE: 4.84837e-06

AIC: -12.2369 Det(Omega_mle): 4.62918e-06

--------------------------------------------------------------------

Results for equation GII_change

================================================================================

coefficient std. error t-stat prob

--------------------------------------------------------------------------------

const -0.024001 0.004196 -5.721 0.000

L1.GII_change 0.185009 0.039930 4.633 0.000

L1.GDP_change -0.026380 0.051164 -0.516 0.606

L2.GII_change -0.078497 0.040530 -1.937 0.053

L2.GDP_change 0.023811 0.051238 0.465 0.642

L3.GII_change 0.064899 0.040651 1.596 0.110

L3.GDP_change 0.050686 0.051064 0.993 0.321

L4.GII_change -0.003574 0.040680 -0.088 0.930

L4.GDP_change 0.072902 0.051130 1.426 0.154

L5.GII_change 0.001834 0.040494 0.045 0.964

L5.GDP_change -0.001066 0.051175 -0.021 0.983

L6.GII_change 0.072632 0.040469 1.795 0.073

L6.GDP_change 0.002571 0.050984 0.050 0.960

L7.GII_change 0.004002 0.039937 0.100 0.920

L7.GDP_change 0.058530 0.050318 1.163 0.245

================================================================================

Results for equation GDP_change

================================================================================

coefficient std. error t-stat prob

--------------------------------------------------------------------------------

const 0.012851 0.003255 3.948 0.000

L1.GII_change -0.013441 0.030978 -0.434 0.664

L1.GDP_change 0.119880 0.039694 3.020 0.003

L2.GII_change -0.003697 0.031443 -0.118 0.906

L2.GDP_change 0.065693 0.039751 1.653 0.098

L3.GII_change -0.008760 0.031537 -0.278 0.781

L3.GDP_change 0.088826 0.039616 2.242 0.025

L4.GII_change -0.002124 0.031560 -0.067 0.946

L4.GDP_change 0.090461 0.039667 2.280 0.023

L5.GII_change 0.044080 0.031416 1.403 0.161

L5.GDP_change 0.027609 0.039702 0.695 0.487

L6.GII_change 0.063477 0.031396 2.022 0.043

L6.GDP_change 0.071206 0.039554 1.800 0.072

L7.GII_change -0.090273 0.030983 -2.914 0.004

L7.GDP_change 0.021749 0.039037 0.557 0.577

================================================================================

Correlation matrix of residuals

GII_change GDP_change

GII_change 1.000000 0.015809

GDP_change 0.015809 1.000000

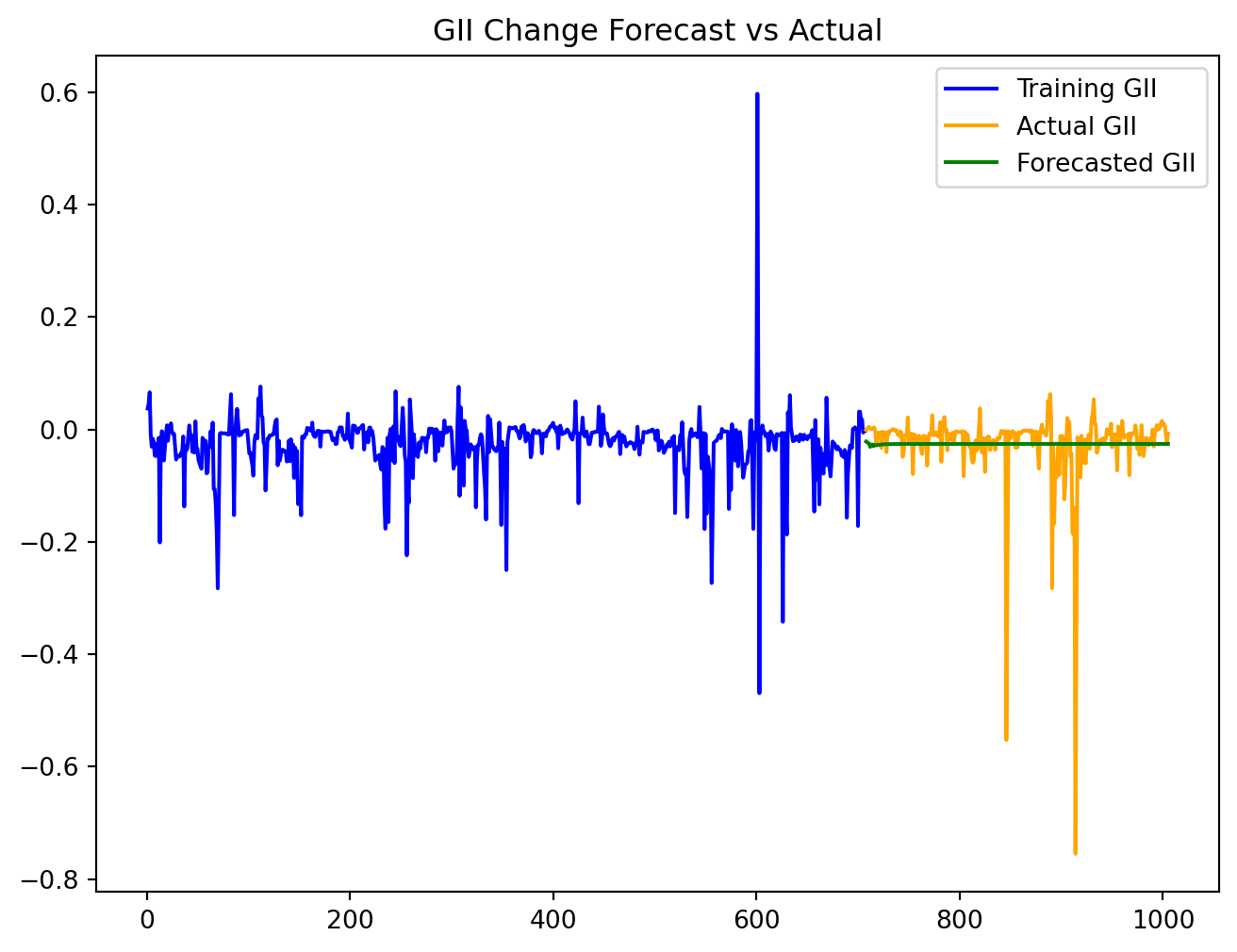

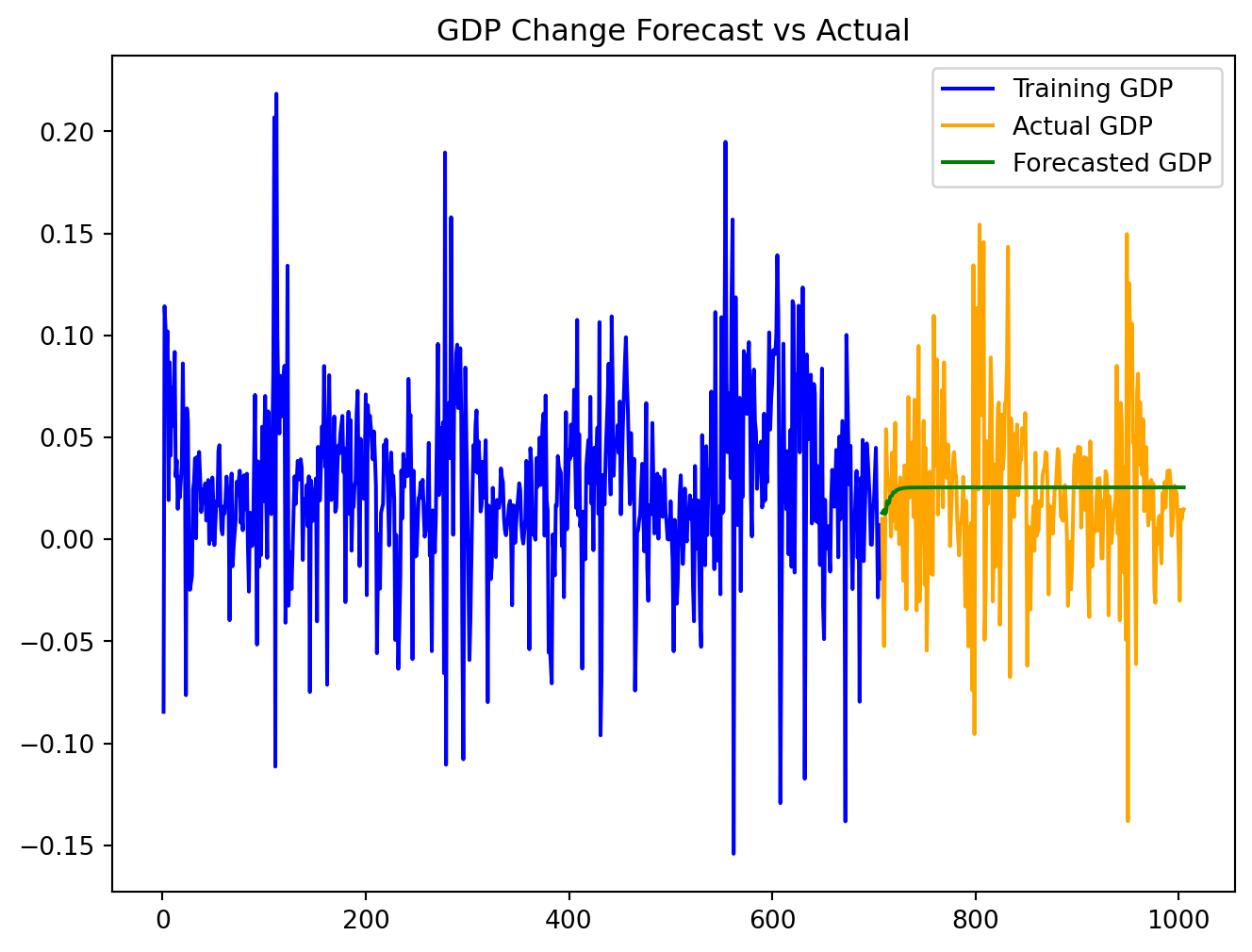

VAR Model: Forecasting

We applied the model learned above to the test data. Based on the plot, the forecast values seem to follow the actual data well, indicating a good model fit caputuring the underlying trends.

# Number of steps to forecast (length of the test set)

n_steps = len(test_data)

# Get the last values from the training set for forecasting

forecast_input = train_data[

['GII_change', 'GDP_change']].values[-time_model_fitted.k_ar:]

# Forecasting

forecast = time_model_fitted.forecast(y=forecast_input, steps=n_steps)

# Create a DataFrame for the forecasted values

forecast_df = pd.DataFrame(forecast, index=test_data.index,

columns=['GII_forecast', 'GDP_forecast'])

# Ensure the index of the forecast_df matches the test_data index

forecast_df.index = test_data.indexplt.figure(figsize=(8, 6))

plt.plot(train_data['GII_change'], label='Training GII', color='blue')

plt.plot(test_data['GII_change'], label='Actual GII', color='orange')

plt.plot(forecast_df['GII_forecast'], label='Forecasted GII', color='green')

plt.title('GII Change Forecast vs Actual')

plt.legend()

plt.show()

plt.figure(figsize=(8, 6))

plt.plot(train_data['GDP_change'], label='Training GDP', color='blue')

plt.plot(test_data['GDP_change'], label='Actual GDP', color='orange')

plt.plot(forecast_df['GDP_forecast'], label='Forecasted GDP', color='green')

plt.title('GDP Change Forecast vs Actual')

plt.legend()

plt.show()

VAR Model: Model Performance

Low values of both MAE and RMSE indicate good model performance with small average errors in predictions.

mae_gii = mean_absolute_error(test_data['GII_change'], forecast_df['GII_forecast'])

mae_gdp = mean_absolute_error(test_data['GDP_change'], forecast_df['GDP_forecast'])

print(f'Mean Absolute Error for GII: {mae_gii}')

print(f'Mean Absolute Error for GDP: {mae_gdp}')Mean Absolute Error for GII: 0.029366879246630565

Mean Absolute Error for GDP: 0.02743613424611046rmse_gii = np.sqrt(mean_squared_error(test_data['GII_change'],

forecast_df['GII_forecast']))

rmse_gdp = np.sqrt(mean_squared_error(test_data['GDP_change'],

forecast_df['GDP_forecast']))

print(f'RMSE for GII: {rmse_gii}')

print(f'RMSE for GDP: {rmse_gdp}')RMSE for GII: 0.06678650784425577

RMSE for GDP: 0.03840528695249478VAR Model: Granger causality test

Granger causality test evaluates whether one time series can predict another.

Based on the output, the lowest p-value is when lag = 2. However, because p-value > 0.05, we fail to reject the null hypothesis and conclude the GDP_change does not Granger-cause the GII_change.

# Perform the Granger causality test

max_lag = 3

test_result = grangercausalitytests(train_data[['GII_change', 'GDP_change']], max_lag,

verbose=True)

Granger Causality

number of lags (no zero) 1

ssr based F test: F=0.0557 , p=0.8135 , df_denom=644, df_num=1

ssr based chi2 test: chi2=0.0560 , p=0.8130 , df=1

likelihood ratio test: chi2=0.0560 , p=0.8130 , df=1

parameter F test: F=0.0557 , p=0.8135 , df_denom=644, df_num=1

Granger Causality

number of lags (no zero) 2

ssr based F test: F=0.2860 , p=0.7514 , df_denom=641, df_num=2

ssr based chi2 test: chi2=0.5764 , p=0.7496 , df=2

likelihood ratio test: chi2=0.5762 , p=0.7497 , df=2

parameter F test: F=0.2860 , p=0.7514 , df_denom=641, df_num=2

Granger Causality

number of lags (no zero) 3

ssr based F test: F=0.8477 , p=0.4681 , df_denom=638, df_num=3

ssr based chi2 test: chi2=2.5711 , p=0.4626 , df=3

likelihood ratio test: chi2=2.5660 , p=0.4635 , df=3

parameter F test: F=0.8477 , p=0.4681 , df_denom=638, df_num=3Conclusion

In wrapping up our analysis, we found no evidence to support a significant relationship between the Change in Real GDP per capita and the Change in the Gender Inequality Index (GII). This suggests that economic growth may not have a direct impact on gender equality. However, our findings open the door to questions for future research.

Future Directions

First, we must consider what other factors might influence the relationship between GDP and GII change. The GII is a composite index, shaped by a myriad of social factors, including cultural norms, legal frameworks, and environmental shifts. Future studies could benefit from incorporating additional predictors into the analysis and exploring the interaction between economic growth and gender equality within specific country contexts.

Second, there’s potential to enhance the predictive power of our Vector Autoregression (VAR) time series model. While we established that GDP change does not cause GII change, our model performed well in forecasting trends for both variables independently. In practice, policymakers may want to forecast GII trends independently of GDP if they are implementing gender-focused policies. Future research could investigate time series modeling to further unravel the dynamics of GII and GDP changes.

So, as we wrap up this chapter, let’s keep our curiosity alive and our questions flowing. After all, every end is just a new beginning in the quest for knowledge!